Financing facing financial fixed put FD is right otherwise bad said

For the tenth diary go out your account have a tendency to secured to your duration of the term, considering the bill on the account is at the very least the minimum Matter. Despite broadening mutual financing, both have increased during the various other prices. The brand new show from financial dumps within the family cost benefits decrease to help you 30.4%, while you are shared fund flower to help you six%.

Close/withdraw of name deposit

You can access our Digital Banking program of overseas given you provides access to the internet and employ the new mobile number, PIN and you may/or biometric availableness approach you registered that have to help you log on. For individuals who’d want to explore our web-dependent platform, only log in thru our webpages with the Electronic Financial option along with your established login background remembering to keep your facts secure. Just a free account owner can access an account, unless of course we otherwise agree that another individual have access to a free account, and you can including body is correctly verified.

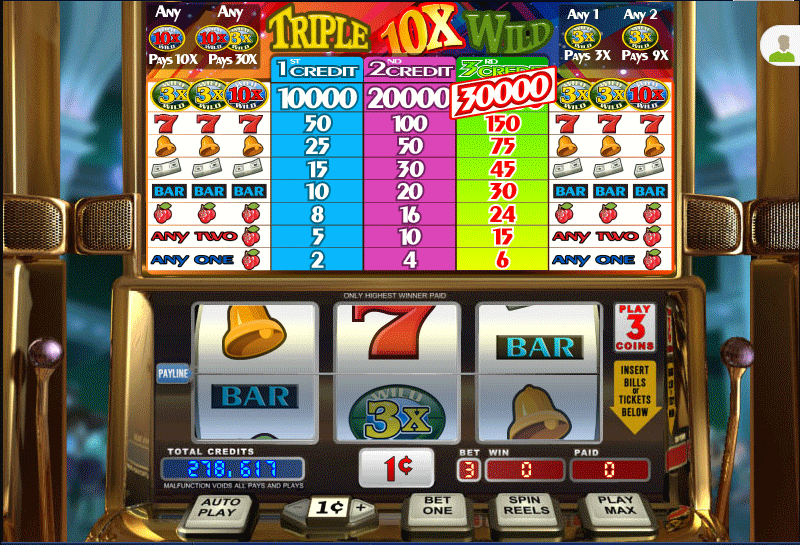

Understand that specific conditional deals accounts can get penalise people that produce distributions by the perhaps not allowing them to earn the best interest rate given https://vogueplay.com/ca/bell-fruit-casino-review/ . However, if you expected those funds inside a pinch, you would not have to hold off 30 weeks as the withdrawal do become instantaneous. You can also simply not earn the utmost interest rate one few days within the account requirements. Additional interest rates apply at for each term put unit and also to various other financing numbers, term lengths and you can focus frequencies. Specific prices do not qualify for additional extra rates and are not found in combination which have any other incentive or special rate of interest offer.

As to why favor a term

Since the an occupant inside Florida, you’re eligible to the fresh get back of your own shelter deposit at the the conclusion your book. If the landlord chooses to hold the deposit within the an attraction-impact membership, they should pay the tenant an annual interest rate out of in the minimum 75% of one’s annualized average interest payable to the account. The new landlord need to pay the eye a year or towards the bottom of one’s tenancy, any kind of happens very first. At the same time, the newest property owner must provide a bill on the put. The newest bill need are the date of acknowledgment, the amount of the newest deposit, and a conclusion of the leasing unit. The brand new landlord must provide which bill within 30 days out of choosing the newest deposit.

- Making a knowledgeable financial choice, you really must be familiar with the newest criteria and you can any consequences.

- For complete information, excite read the Put issues fees and you will costs guide.

- When you’re unsure in the any information on their SMSF, you can consider their Believe Deed otherwise talk to your own accountant/economic coach.

- Feedback, recommendations, analyses & suggestions would be the author’s by yourself, and possess not been analyzed, supported otherwise passed by these entities.

- All of our financial circle covers 3110 branches/ financial outlets and you may 3052 ATMs bequeath around the India, coating step one,64,000 communities, so we provides member offices in the London, Dubai and you can Abu Dhabi.

Citi also offers finest-tier benefits for its greatest consumers that have highest stability. Unlock a different Citibank Business Family savings and you can secure $300 when you put $5,one hundred thousand so you can $19,999 on your the newest membership within this forty-five days, then keep up with the balance for the next forty-five weeks. Earn $750 which have an excellent $20,one hundred thousand in order to $99,999 deposit; $step one,500 which have a good $75,100 put; $step one,five hundred which have a $100,000 lowest put and you will $2,one hundred thousand having a great $two hundred,100000 minimum put.

To possess an additional level away from shelter, think choosing a financial who has another seeing area in which people can also be open the safe deposit boxes. The newest penalty costs for the premature detachment away from fixed places typically variety from 0.5 to three% of the interest rate. It is as indexed you to definitely only desire is actually influenced and you may perhaps not the main amount. Let’s say you put ₹10 lakhs in the a fixed deposit for three years during the 7.5% annually. When you first spent, the speed to own a single-year term try 7% a-year.

In a nutshell, the brand new protection deposit laws in the Florida 2023 has brought high change in order to landlord-occupant interactions. Landlords have a choice of asking a charge as opposed to a security deposit, as well as the maximum security deposit restriction could have been smaller to two months’ book. While you are Users Credit Union Certification Account also provides a multitude of Video game account ranging from 91 weeks to help you five years, in addition to jumbo Cds, very costs are lower. Like most Dvds, for many who withdraw fund before Cd features mature, you’ll getting charged an early detachment punishment.

It’s also advisable to be wary of any person regional offering let as they is generally accomplices for the fraud. “I don’t think that might possibly be an excellent option started 2nd 12 months. I’m just in case those things will not have the gorgeous costs they’ve been having now,” the guy said. All the information establish more than are general in general and it has been waiting instead looking at the objectives finances otherwise needs. By giving this article ANZ doesn’t want to give any economic guidance or other information otherwise suggestions. You ought to search separate financial, judge, taxation or other related suggestions which have mention of your particular issues. It calculator is offered to have illustrative motives simply and won’t create a quote.